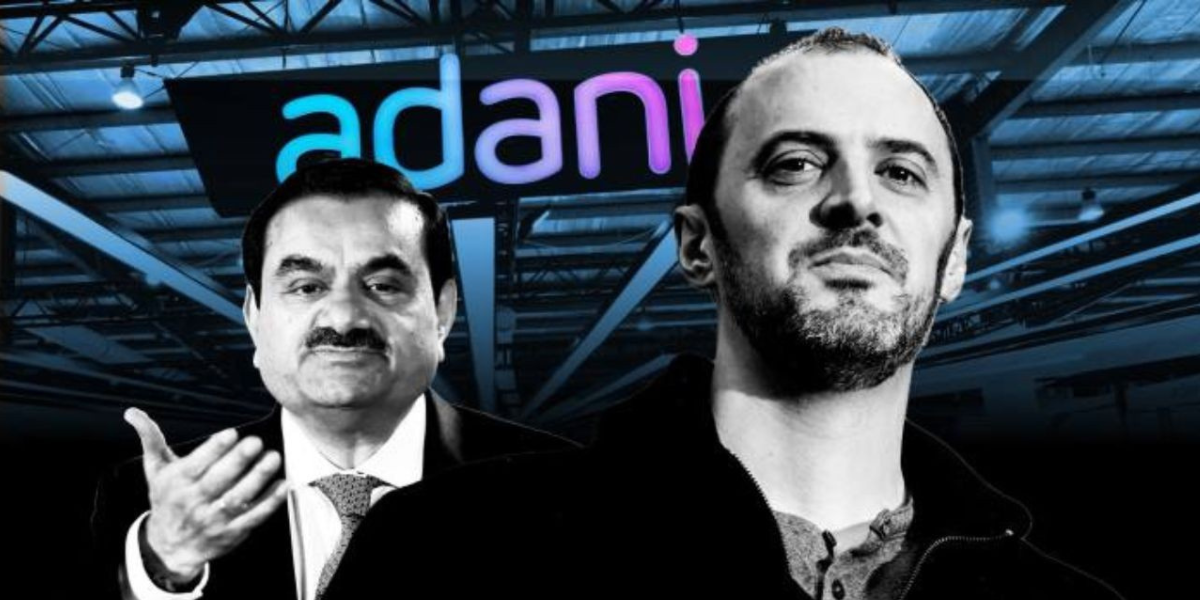

The Adani-Hidenburg case has taken the financial world by storm, with allegations of accounting fraud and stock manipulation against the Adani Group. The recent Supreme Court verdict has added a new chapter to this saga, influencing the stock market and investor sentiment. In this comprehensive blog post, we’ll delve into the details of the case, the role of SEBI, and the implications of the court’s decision.

Table of Contents

Understanding the Adani-Hindenburg Allegations:

Before we dissect the Supreme Court’s verdict, let’s revisit the allegations made by Hindenburg Research and the subsequent impact on the Adani Group’s stock prices. The accusations of “brazen accounting fraud” and “stock manipulation” sent shockwaves through the market, triggering a significant drop in stock prices. Explore the intricacies of Hindenburg’s report and its immediate consequences on the financial landscape.

SEBI’s Investigative Role:

The Securities and Exchange Board of India (SEBI) stepped into the spotlight as the regulatory body tasked with investigating the allegations against the Adani Group. Analyze SEBI’s role in depth, exploring its powers, limitations, and the specific directions given by the Supreme Court. Understand the timeline of SEBI’s investigation and its request for a six-month extension to complete the probe.

Supreme Court’s Verdict and Implications:

Break down the key points of the Supreme Court’s verdict on the Adani-Hindenburg case. Examine the court’s decision to uphold SEBI’s authority, its refusal to transfer the investigation to the Special Investigation Team (SIT), and the specific directives given to SEBI. Discuss the court’s concerns about SEBI’s progress and the reserved judgment on various pleas related to the case.

SEBI’s Ongoing Investigation:

Provide the latest updates on SEBI’s investigation into the 24 cases related to the Adani Group. Highlight any significant findings, actions taken by SEBI, and the court’s instructions for a timely conclusion of the inquiry. Discuss the implications of SEBI’s findings on the Adani Group and the broader market.

Market Dynamics Post-Verdict:

Explore the immediate and sustained impact of the Supreme Court’s verdict on the stock market, particularly Adani Group shares. Analyze the surge in stock prices, investor reactions, and the overall market sentiment. Examine how the market’s perception of the ruling may have influenced future investments and confidence in the Adani Group.

Investor Sentiment and Adani Group’s Response:

Delve into the reactions of investors following the Supreme Court’s verdict. Assess the mixed sentiment among investors, the relief experienced by the Adani Group, and Gautam Adani’s response to the court’s decision. Explore how the verdict may have shaped investor confidence and influenced the Adani Group’s standing in the market.

Regulatory Efficiency and Market Confidence:

Discuss the broader implications of the Supreme Court’s decision on regulatory efficiency in the stock market. Analyze how the verdict signals a commitment to maintaining a robust regulatory framework and its potential impact on future investigations. Explore the role of transparency and governance standards in shaping market confidence.

Its effect on stock market

After the Supreme Court’s verdict on the Adani-Hindenburg case, some Adani Group companies did experience stock price declines. However, the declines were not observed in all companies within the group. The following are the notable impacts on the stock prices of Adani Group companies after the Supreme Court’s verdict:

- Adani Enterprises: The stock of Adani Enterprises rose by 6.4% in early trade on the day of the Supreme Court’s verdict.

- Adani Energy Solutions: The stock of Adani Energy Solutions surged by 14% following the verdict.

- Adani Power, Adani Green Energy, Adani Ports, and Adani Wilmar: These companies saw their stocks rise by up to 7.

- Adani Transmission, Adani Power, Adani Green, and Adani Wilmar: These companies’ stocks were locked in the 5% upper circuit limit after the Supreme Court’s order, indicating a significant positive impact on their stock price

Conclusion:

Summarize the key findings of the blog post, emphasizing the intricate details of the Adani-Hindenburg case, SEBI’s role, the Supreme Court’s verdict, and the subsequent market dynamics. Reflect on the broader implications for regulatory frameworks, investor confidence, and the evolving landscape of financial investigations in India.

By providing a comprehensive analysis of the Adani-Hindenburg case, this blog aims to offer readers a nuanced understanding of the events, their implications, and the evolving narrative in the Indian financial market