The IPO market in 2024 is expected to be filled with excitement and anticipation, as several highly-anticipated companies are set to go public. In this blog post, we will explore the top upcoming IPOs in 2024, providing you with all the essential information you need to know. From financials to market trends, we will cover it all. So, buckle up and get ready for an exciting ride as we dive into the world of upcoming IPOs in 2024.

Table of Contents

Top Upcoming IPOs in 2024

Stripe: As an online payments giant, Stripe has been one of the most-anticipated IPOs since posting tremendous growth. The company is expected to IPO in 2024, with a potential valuation of around $100 billion.

Klarna: A Swedish fintech company known for its buy-now, pay-later services, Klarna is also expected to IPO in 2024. The company’s unique business model and rapid growth have made it a popular choice for investors.

Chime: A real estate technology company, Chime is planning an IPO for 2024. The company’s innovative platform and potential for disruption in the real estate industry make it a company to watch.

Databricks: A data analytics company, Databricks is expected to IPO in 2024. With a strong presence in the data analytics market, Databricks is poised to capitalize on the growing demand for data-driven solutions.

Reddit: The powerful online forum confidentially filed its Form S-1 with the SEC in December 2021, making its intention to go public official. Despite some silence on the matter, many investors are still anticipating the company to IPO in 2024.

Impossible Foods: A plant-based food company, Impossible Foods is also expected to IPO in 2024. The company’s innovative plant-based meat alternatives and strong market presence make it a promising IPO candidate.

IPO Market Trends and Predictions

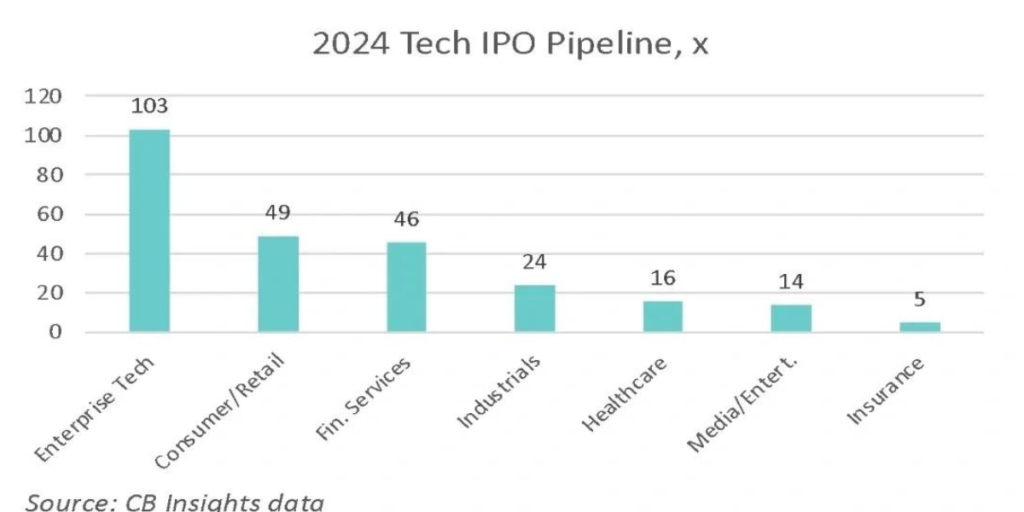

The IPO market in 2024 is expected to be more stable and supportive for companies aiming to go public, allowing both retail and institutional investors access to a wider range of investment opportunities. Some analysts predict a 10% increase in IPO activity and a 20% increase in proceeds raised year-over-year. However, there are potential headwinds that could affect the market, such as rising interest rates, inflation, and ongoing geopolitical events

How can Investors prepare for the upcoming IPOs in 2024

Research the companies: Stay informed about the latest IPO pipeline and identify the companies you are interested in. Some of the most anticipated IPOs include Stripe, Klarna, Chime, Databricks, Reddit, and Impossible Foods.

Monitor market trends: Keep an eye on market conditions and investor sentiment, as these factors can significantly impact the success of IPOs. Analysts predict a 10% increase in IPO activity and a 20% increase in proceeds raised year-over-year.

Evaluate financial health: Companies considering going public should demonstrate strong fundamentals, a path to profitability, and resilience amid weak economic conditions. Analyze the financials of the companies you are interested in and assess their potential for growth and profitability.

Consider risks: Be aware of potential headwinds that could affect the market, such as rising interest rates, inflation, and ongoing geopolitical events. These risks can impact the performance of IPOs and should be factored into your investment decisions.

Diversify your portfolio: While some investors may focus on high-profile IPOs, it’s essential to diversify your portfolio by investing in a mix of companies across different sectors and industries. This can help mitigate risks and increase the potential for long-term growth.

Stay informed: Keep up-to-date with the latest news and developments related to the IPOs you are interested in. This includes filing documents, regulatory approvals, and any changes in pricing or timing.

Be patient: The IPO market can be volatile, and some companies may postpone their IPO plans due to market conditions. Be patient and willing to wait for the right opportunities, but also be prepared to act quickly when a company you are interested in goes public.

Invest wisely: When the time comes to invest in an IPO, ensure that you are investing for the long term and not solely based on short-term market fluctuations. This approach can help you minimize risks and maximize potential returns.

By following these steps, investors can better prepare for the upcoming IPOs in 2024 and make informed decisions about which companies to invest in.

How can Investors better evaluate a company’s IPO prospects

Company’s business model and industry: Assess the company’s industry, growth prospects, and competitive position within the market0. Understand the company’s value proposition and how it differentiates itself from competitors.

Strong management team: A capable and experienced management team is crucial for the company’s success. Research the team’s track record and their ability to manage the company effectively.

Compelling equity story: A strong equity story helps to communicate the company’s value proposition to potential investors. Look for a clear and compelling narrative that justifies the company’s valuation.

Fair valuation: Evaluate the company’s valuation based on its financials, industry comparables, and growth prospects. Ensure that the valuation is in line with the company’s financial performance and future prospects.

Good corporate governance: Assess the company’s governance structure, including the board of directors and executive management. Strong corporate governance practices can help protect investor interests and promote long-term success.

IPO readiness: Ensure that the company is prepared to meet capital market requirements and investor expectations. This includes having accurate financial statements, robust disclosure practices, and a solid track record of meeting financial targets.

ESG-embedded business strategy: Investors increasingly focus on environmental, social, and governance (ESG) factors when evaluating IPO prospects. Consider how the company incorporates ESG principles into its business strategy and operations.

Demand and market conditions: Strong demand for the company’s shares can lead to a higher stock price. Monitor market conditions and investor sentiment to gauge the potential success of the IPO.

Conclusion

The upcoming IPOs in 2024 promise to be filled with excitement and anticipation, as several highly-anticipated companies are set to go public. With a stable market environment and strong investment interest, 2024 is shaping up to be a banner year for IPOs. Keep an eye on these top upcoming IPOs and stay informed about the latest developments as they approach their public offerings.